Are you looking to explore a dynamic and innovative business venture? Look no further than Fast Cash Business. This article delves into the intricacies of this exciting opportunity, providing you with a comprehensive overview of what it entails, its potential, and how you can get started.

Understanding Fast Cash Business

Fast Cash Business refers to a variety of ventures that offer quick and convenient financial services. These services can range from payday loans to pawnshops, and even include mobile payment solutions. The common denominator is the promise of immediate access to cash, catering to individuals and businesses in need of quick financial solutions.

Market Potential

The demand for fast cash services has been on the rise, driven by factors such as economic uncertainty, rising living costs, and the increasing number of people living paycheck to paycheck. According to a report by the Consumer Financial Protection Bureau, approximately 12 million Americans use payday loans each year. This indicates a significant market opportunity for those looking to enter the fast cash business.

Types of Fast Cash Businesses

Here are some of the most popular types of fast cash businesses you can consider:

| Type of Business | Description |

|---|---|

| Payday Loans | Offer short-term loans to individuals in exchange for a portion of their next paycheck. These loans typically come with high-interest rates and are meant to be repaid within a few weeks. |

| Pawnshops | Provide loans in exchange for personal belongings, which are returned to the borrower once the loan is repaid. If the loan is not repaid, the pawnshop keeps the item. |

| Check Cashing Services | Allow individuals to cash their checks quickly, often for a small fee. This service is particularly popular among those who do not have access to traditional banking services. |

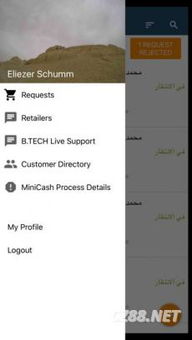

| Mobile Payment Solutions | Offer a convenient way to pay for goods and services using a mobile device. These solutions can include mobile wallets, mobile point-of-sale (POS) systems, and mobile banking apps. |

Getting Started

Starting a fast cash business requires careful planning and consideration of various factors. Here are some key steps to help you get started:

-

Identify your target market: Determine who your customers will be and what their specific needs are. This will help you tailor your services to meet their requirements.

-

Choose the right business model: Decide which type of fast cash business suits your goals and resources. Consider factors such as startup costs, regulatory requirements, and competition in your area.

-

Understand the regulations: Fast cash businesses are subject to strict regulations, particularly when it comes to interest rates and loan terms. Make sure you are aware of these regulations and comply with them.

-

Develop a solid business plan: Outline your business goals, strategies, and financial projections. This will help you secure funding and stay focused on your objectives.

-

Build a strong network: Establish relationships with potential customers, suppliers, and industry professionals. This will help you gain valuable insights and support as you grow your business.

Challenges and Considerations

While the fast cash business offers significant opportunities, it also comes with its own set of challenges:

-

High competition: The fast cash industry is highly competitive, with numerous players vying for market share.

-

Regulatory scrutiny: Fast cash businesses are subject to strict regulations, which can be challenging to navigate.

-

Customer trust: Building trust with customers is crucial, especially given the negative perception associated with some fast cash services.

Conclusion

Fast Cash Business presents a unique opportunity for entrepreneurs looking to enter a dynamic and growing industry. By understanding the market potential, types of businesses, and the challenges involved, you can make informed decisions and increase your chances of success. Remember to stay compliant with regulations, build a strong network, and focus on customer satisfaction to thrive in this exciting field.