How to Make Money Day Trading Cryptocurrency

Day trading cryptocurrency can be an exciting and potentially lucrative venture. However, it requires a solid understanding of the market, risk management skills, and a disciplined approach. In this article, we will delve into the various aspects of day trading cryptocurrency, providing you with the knowledge and tools to make informed decisions and potentially earn profits.

Understanding the Basics

Before diving into the world of day trading cryptocurrency, it’s crucial to have a clear understanding of the basics. Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange. The most well-known cryptocurrency is Bitcoin, but there are thousands of others, each with its own unique features and market dynamics.

Day trading involves buying and selling cryptocurrencies within the same trading day. The goal is to capitalize on short-term price fluctuations to make a profit. Unlike long-term investing, day trading requires constant monitoring and quick decision-making.

Choosing the Right Cryptocurrency

Selecting the right cryptocurrency is essential for successful day trading. Here are some factors to consider:

-

Market capitalization: Look for cryptocurrencies with a significant market capitalization, as they tend to have more liquidity and stability.

-

Volume: Choose cryptocurrencies with high trading volume, as it indicates a higher level of interest and activity in the market.

-

Market sentiment: Stay updated with the latest news and trends in the cryptocurrency market to gauge market sentiment.

-

Unique features: Consider the unique features and potential of each cryptocurrency, as they can impact its price and demand.

Setting Up Your Trading Environment

Creating a conducive trading environment is crucial for successful day trading. Here are some key elements to consider:

-

Exchange selection: Choose a reputable cryptocurrency exchange that offers a wide range of trading pairs and reliable services.

-

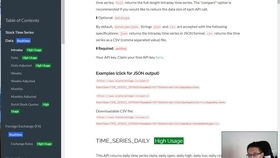

Trading platform: Opt for a user-friendly trading platform that provides real-time data, advanced charting tools, and customizable alerts.

-

Security measures: Ensure that your trading account is secure by enabling two-factor authentication and using strong passwords.

-

Technical analysis tools: Familiarize yourself with technical analysis tools and indicators to make informed trading decisions.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in day trading. Here are some key components to consider:

-

Entry and exit points: Determine the criteria for entering and exiting trades, such as price levels, technical indicators, and market sentiment.

-

Stop-loss and take-profit levels: Set stop-loss and take-profit levels to manage risk and protect your profits.

-

Position sizing: Determine the appropriate position size for each trade based on your risk tolerance and capital allocation.

-

Time frame: Choose a trading time frame that aligns with your trading style and market conditions.

Managing Risk

Risk management is a critical aspect of day trading. Here are some key risk management strategies:

-

Stop-loss orders: Use stop-loss orders to limit potential losses on each trade.

-

Position sizing: Avoid over-leveraging and maintain a diversified portfolio to mitigate risk.

-

Emotional discipline: Stay disciplined and avoid making impulsive decisions based on emotions.

-

Continuous learning: Stay updated with market trends, trading strategies, and risk management techniques.

Monitoring and Analyzing Performance

Regularly monitoring and analyzing your trading performance is crucial for continuous improvement. Here are some tips:

-

Track your trades: Keep a record of all your trades, including entry and exit points, position size, and the rationale behind each decision.

-

Review your strategy: Analyze your trading strategy and make adjustments as needed based on your performance and market conditions.

-

Stay informed: Keep up with the latest market trends, news, and developments to make informed decisions.

-

Seek feedback: Share your trading experiences with peers or mentors to gain insights and improve your skills.