Understanding Day Trading

Day trading online has become an increasingly popular way to make money for individuals looking to capitalize on short-term market movements. By buying and selling financial instruments within the same trading day, you can potentially earn profits. However, it’s important to approach day trading with a well-informed strategy and a clear understanding of the risks involved.

Choosing the Right Platform

Before you start day trading, you need to choose a reliable and user-friendly platform. Look for platforms that offer real-time market data, advanced charting tools, and a variety of financial instruments to trade. Some popular platforms include TD Ameritrade, ETRADE, and Interactive Brokers. Make sure to read reviews and compare fees, commissions, and customer support before making your decision.

Developing a Trading Plan

A trading plan is a crucial component of successful day trading. It should outline your trading strategy, risk management rules, and exit criteria. Determine the types of assets you want to trade, such as stocks, options, or cryptocurrencies, and set clear entry and exit points based on technical analysis or fundamental analysis. Your plan should also include a maximum daily loss limit to protect your capital.

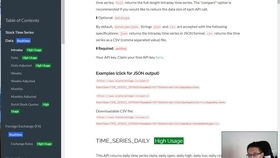

Learning Technical Analysis

Technical analysis is a key tool for day traders, as it involves analyzing historical price and volume data to identify patterns and trends. Familiarize yourself with various technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). Practice using charting tools to identify potential buy and sell signals, and be prepared to adapt your strategy as market conditions change.

Understanding Risk Management

Risk management is essential for day trading success. One of the most important risk management techniques is position sizing, which involves determining how much capital to allocate to each trade. A common rule of thumb is to risk no more than 1-2% of your total capital on a single trade. Additionally, set stop-loss orders to limit potential losses and avoid emotional decision-making.

Staying Informed

Market conditions can change rapidly, so it’s crucial to stay informed about the latest news and events that may impact your trades. Follow financial news outlets, read market reports, and keep an eye on economic indicators. Being aware of upcoming corporate earnings reports, economic data releases, and geopolitical events can help you make more informed trading decisions.

Building a Portfolio

As a day trader, you may want to diversify your portfolio to reduce risk. Consider trading a variety of assets, such as stocks, options, and futures, to spread out your risk. However, be cautious not to over-diversify, as this can make it difficult to manage your trades effectively. Focus on assets that you are familiar with and that align with your trading strategy.

Practicing with a Demo Account

Before you start trading with real money, it’s a good idea to practice with a demo account. Many online brokers offer demo accounts that allow you to trade with virtual money, giving you the opportunity to test your trading strategy without risking your capital. Use this time to refine your skills, learn from your mistakes, and gain confidence in your trading abilities.

Monitoring Your Performance

Keep track of your trading performance to identify areas for improvement. Use a trading journal to record your trades, including the reason for entering and exiting the trade, the amount of capital at risk, and the outcome. Analyze your performance regularly to identify patterns in your trading and adjust your strategy accordingly.

Continuous Learning

The financial markets are constantly evolving, so it’s important to stay updated with the latest trading strategies, tools, and technologies. Attend webinars, read books, and join online communities to learn from experienced traders. Continuous learning will help you adapt to changing market conditions and improve your chances of success.

Conclusion

Day trading online can be a lucrative way to make money, but it requires discipline, patience, and a well-thought-out strategy. By choosing the right platform, developing a trading plan, learning technical analysis, understanding risk management, staying informed, building a diversified portfolio, practicing with a demo account, monitoring your performance, and continuously learning, you can increase your chances of success in the world of day trading.