Understanding Work from Home

Are you looking for a way to make money online while working from the comfort of your home? The concept of working from home has gained immense popularity in recent years, offering flexibility and the opportunity to earn a living without the need to commute. In this article, we will delve into various aspects of working from home and provide you with a comprehensive guide to making money online.

Types of Work from Home Opportunities

There are numerous ways to make money online from home. Here are some of the most popular options:

-

Freelancing: Platforms like Upwork, Freelancer, and Fiverr allow you to offer your skills and services to clients worldwide. Whether you are a writer, graphic designer, programmer, or virtual assistant, there is a market for your talents.

-

Online Teaching: If you have expertise in a particular subject, you can teach online through platforms like VIPKid, iTutorGroup, or Preply. This option is particularly suitable for those with teaching qualifications or experience.

-

Remote Customer Service: Many companies are looking for remote customer service representatives to handle inquiries and provide support via phone, email, or chat. Websites like LiveOps and Working Solutions offer such opportunities.

-

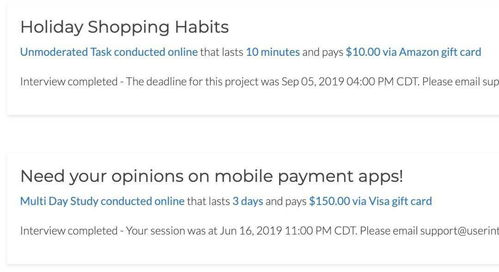

Online Surveys and Market Research: Participating in online surveys and market research studies can be a way to earn some extra cash. Websites like Swagbucks, Survey Junkie, and Vindale Research provide such opportunities.

-

Online Content Creation: If you have a passion for writing, photography, or video production, you can create content for blogs, YouTube channels, or social media platforms. Monetization can be achieved through advertising, sponsorships, and affiliate marketing.

Setting Up Your Home Office

Creating a dedicated workspace at home is crucial for productivity and maintaining a work-life balance. Here are some tips to set up your home office:

-

Choose a quiet and well-lit area: Find a spot in your home where you can work without distractions and with ample natural light.

-

Invest in a comfortable chair and desk: A good chair and desk can help prevent discomfort and maintain good posture during long hours of work.

-

Organize your workspace: Keep your desk and surrounding area organized to minimize distractions and improve efficiency.

-

Set boundaries: Communicate with your family or roommates about your work schedule and boundaries to maintain a healthy work-life balance.

Building a Professional Online Presence

Creating a professional online presence is essential for attracting clients and building a successful work-from-home career. Here are some tips:

-

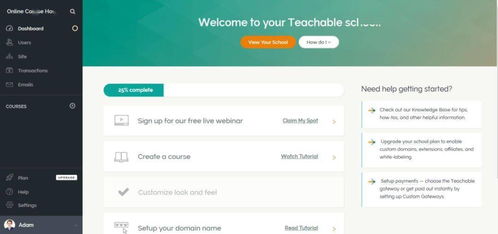

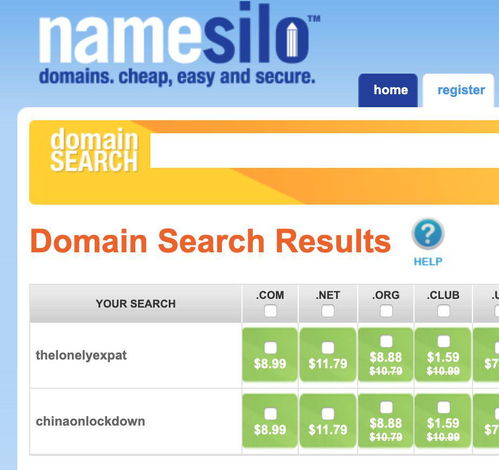

Create a professional website or portfolio: Showcase your skills, experience, and previous work to potential clients.

-

Use social media platforms: LinkedIn is particularly useful for networking and connecting with potential clients and employers.

-

Optimize your resume and cover letter: Tailor your resume and cover letter to each job application, highlighting relevant skills and experiences.

-

Stay up-to-date with industry trends: Keep learning and staying informed about the latest developments in your field to remain competitive.

Time Management and Productivity

Effective time management and productivity are crucial for success in a work-from-home environment. Here are some tips:

-

Set clear goals: Define your daily, weekly, and monthly goals to stay focused and motivated.

-

Use time management tools: Tools like Trello, Asana, and Google Calendar can help you organize your tasks and prioritize your work.

-

Take regular breaks: Schedule short breaks throughout the day to rest and recharge.

-

Limit distractions: Identify and minimize potential distractions in your home environment.

Financial Considerations

When working from home, it’s important to consider the financial aspects of your new career. Here are some tips:

-

Understand your tax obligations: Consult with a tax professional to ensure you are compliant with tax laws and regulations.

-

Keep track of your expenses: Keep receipts and records of all business-related expenses to claim deductions.