Understanding Your Income Streams

Have you ever wondered how you can make your money work harder for you? Understanding your income streams is the first step towards financial independence and security. By diversifying your income sources, you can ensure a steady flow of cash into your life, allowing you to achieve your financial goals with ease.

Traditional Income Streams

Most people rely on traditional income streams, such as a salary from a job or a pension. While these sources are reliable, they often come with limitations. Here’s a breakdown of some common traditional income streams:

| Income Stream | Description |

|---|---|

| Salary | Regular income from an employer, often with benefits and a set schedule. |

| Pension | Income received after retirement, typically from a government or private pension plan. |

| Self-Employment | Income generated from running your own business or freelancing. |

| Investments | Income from investments such as stocks, bonds, or real estate. |

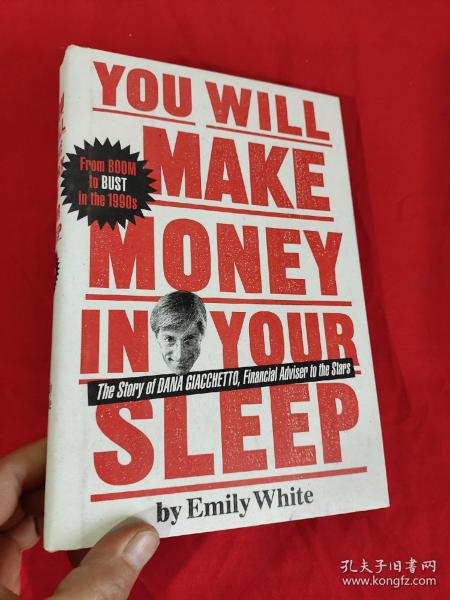

Passive Income Streams

Passive income streams are a great way to make your money work for you while you sleep. These income sources require minimal effort to maintain and can provide a steady stream of income over time. Here are some popular passive income streams:

-

Real Estate: Renting out properties can generate a consistent income, especially if you have multiple units.

-

Dividend Stocks: Investing in dividend-paying stocks can provide a regular income stream, as you receive dividends on your investment.

-

Online Courses: Creating and selling online courses can generate income for years to come, as students continue to enroll.

-

Affiliate Marketing: Promoting products or services online and earning a commission for each sale can be a lucrative passive income source.

Building Multiple Income Streams

One of the best ways to make your money work harder for you is to build multiple income streams. This diversification can help protect you from financial downturns and provide a cushion for unexpected expenses. Here are some tips for building multiple income streams:

-

Identify Your Skills: Determine what skills you have that can be monetized. Whether it’s writing, graphic design, or programming, there’s likely a market for your talents.

-

Invest in Education: Continuously learning and improving your skills can open up new opportunities for income.

-

Network: Building a strong network of contacts can lead to new business opportunities and partnerships.

-

Automate: Use technology to automate as much of your income streams as possible, freeing up your time to focus on other ventures.

Monitoring and Managing Your Income Streams

Once you have established multiple income streams, it’s important to monitor and manage them effectively. Here are some tips for keeping your income streams in check:

-

Track Your Income: Keep a detailed record of all your income sources to ensure you’re maximizing your earnings.

-

Set Financial Goals: Establish clear financial goals to guide your income management decisions.

-

Review and Adjust: Regularly review your income streams to identify any areas for improvement or potential risks.

-

Seek Professional Advice: Consult with a financial advisor to help you make informed decisions about your income streams.

Conclusion

By understanding and diversifying your income streams, you can make your money work harder for you. Whether you’re looking to achieve financial independence, build wealth, or simply secure your financial future, the key is to be proactive and strategic in managing your income. With the right approach, you can create a life where your money works for you, rather than the other way around.